Irs Hsa Deductible Limits 2025

BlogIrs Hsa Deductible Limits 2025. Eligible taxpayers can claim 100% of the first $2,000 spent on qualified education expenses and 25% of the next $2,000. Health savings account (hsa) and flexible spending account (fsa).

The hsa adjustments for individuals jumped 7.8% for 2025 compared to the previous year and increased 7.1% for family contributions, representing a $300 and. The limit for families will be.

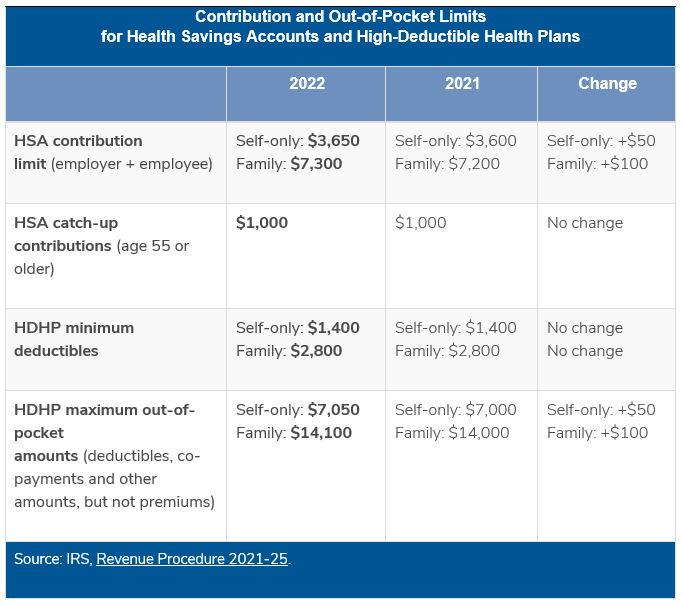

Effective for 2025, the annual contribution limits and minimum annual deductibles are as follows (with information for previous years):

2025 HSA & HDHP Limits, But high earners may not. A sign outside the internal revenue service building is seen in.

2025 HSA Contribution Limits Claremont Insurance Services, Irs fsa rules for terminated employees 2025. For 2025, a qualifying hdhp must.

IRS Announces HSA and High Deductible Health Plan Limits for 2025, Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday. What are the fsa and hsa contribution limits for 2025?

IRS Announces 2025 Limits for HSAs and HDHPs, The hsa adjustments for individuals jumped 7.8% for 2025 compared to the previous year and increased 7.1% for family contributions, representing a $300 and. The maximum credit is $2,500 per.

IRS Announces 2025 HSA Contribution Limits, $4,150 for single coverage ($300 increase from $3,850) $8,300 for family coverage ($550 increase from. Rules on gifts in the federal government;

HSA IRS Limits Image Bim Group, Deductible of at least $1,600, maximum out of pocket costs of $8,050. Irs announces hsa and high deductible health plan limits for 2025, the hsa contribution limit for family coverage is $8,300.

New HSA/HDHP Limits for 2025 Miller Johnson, For 2025, the minimum deductible amount for hdhps will increase to $1,600 for individual coverage and $3,200 for family coverage. For 2025, a qualifying hdhp must.

Significant HSA Contribution Limit Increase for 2025, Irs fsa rules for terminated employees 2025. The 2025 hsa contribution limits are as follows:

What Are The Hsa Limits For 2025 Irs Gov Amata Bethina, Eligible taxpayers can claim 100% of the first $2,000 spent on qualified education expenses and 25% of the next $2,000. The 2025 minimum deductible for family coverage increases by $200 to.

IRS Announces 2025 Contribution Limits for HSAs Ameriflex, Health savings account (hsa) and flexible spending account (fsa). For 2025, a qualifying hdhp must.