600 Charitable Deduction 2025

Blog$600 Charitable Deduction 2025. Page last reviewed or updated: To claim a charitable contribution deduction, you must itemize your deductions rather than take the standard deduction.

In 2025, the irs temporarily allowed taxpayers to. Here are the 2025 standard deduction amounts by filing status, which are claimed on returns that were due april 15, 2025, or are due oct.

T230068 Tax Benefit of the Deduction for Charitable Contributions, To claim a charitable contribution deduction, you must itemize your deductions rather than take the standard deduction. The legislation would raise the $300/$600 cap to roughly $4,600 for individuals/$9,200 for couples and extend the deduction through years 2025 and 2025.

The Complete 2025 Charitable Tax Deductions Guide, What to know if you're paid via paypal, venmo or cash app financially+ posted: Advocates want lawmakers to extend the provision.

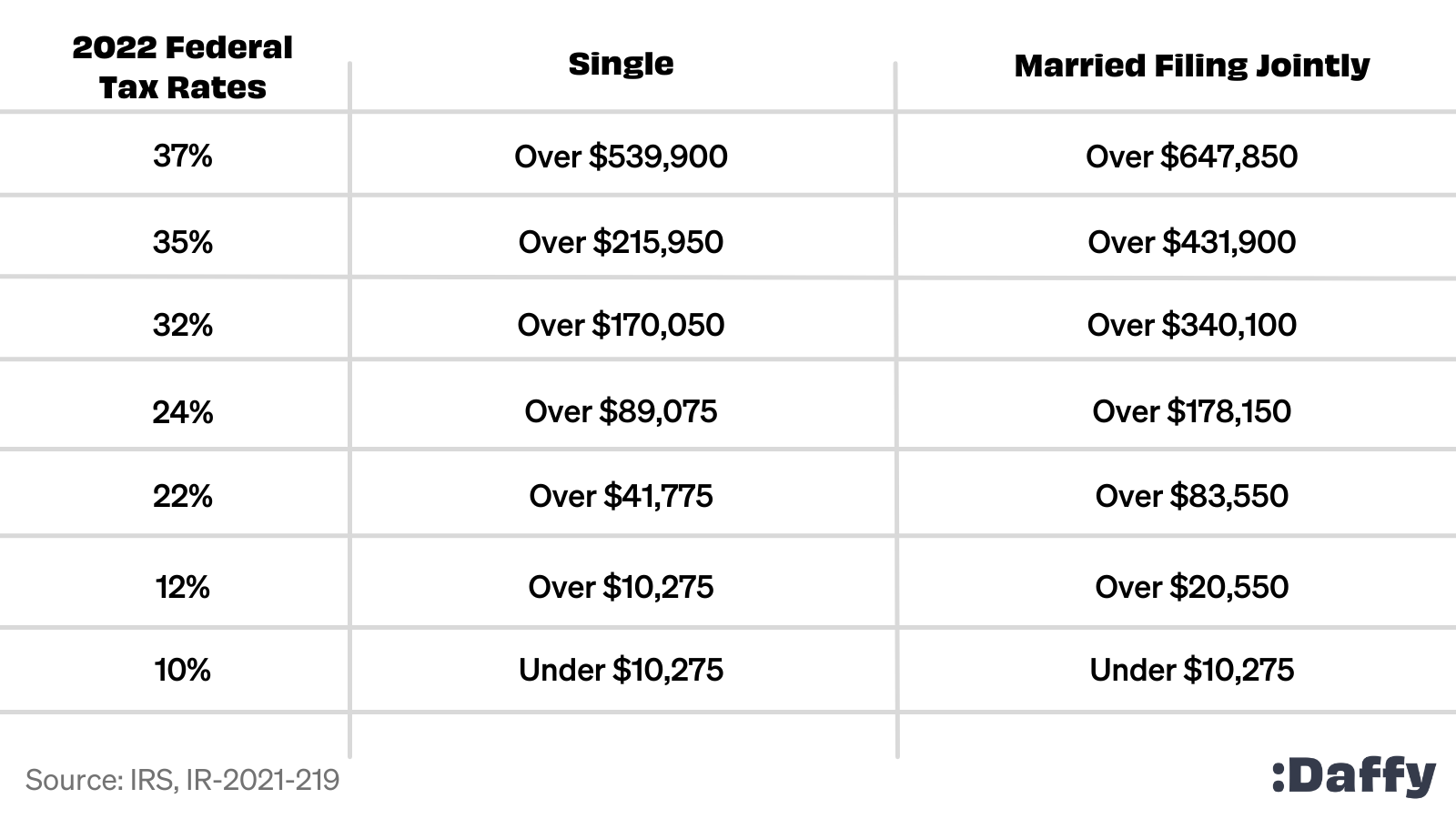

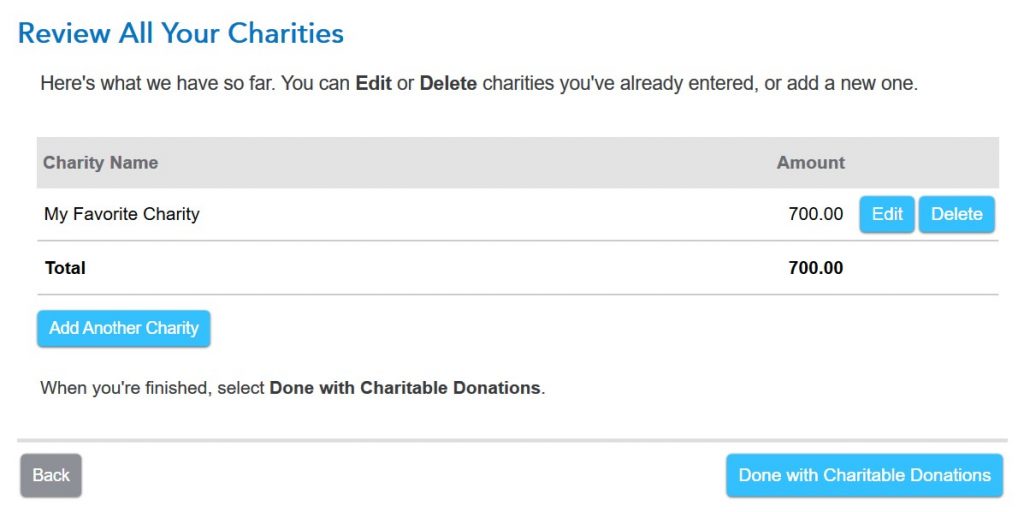

TurboTax 2025 CARES Act 2.0 600 Charity Donation Deduction, The charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. For 2025, this amount is up to $600 per tax return for those filing married filing jointly and $300 for other filing statuses.) donations of both cash and property are deductible.

T230065 Tax Benefit of the Deduction for Charitable Contributions, Climate action tax credit — effective july 1, 2025, the maximum annual climate action. Here are the 2025 standard deduction amounts by filing status, which are claimed on returns that were due april 15, 2025, or are due oct.

Make sure you claim your charitable tax deductions, on Form 1040 or, To get the charitable deduction, you usually have to itemize your taxes. The legislation would raise the $300/$600 cap to roughly $4,600 for individuals/$9,200 for couples and extend the deduction through years 2025 and 2025.

IRS Joins Nonprofit Groups to Promote 600 Charitable Tax Deduciton, The temporary option to claim up to. To claim a charitable contribution deduction, you must itemize your deductions rather than take the standard deduction.

You need to know these facts about charitable deductions in 2025 C, Generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. In a recent press release, the irs reminds taxpayers that a special tax provision will allow more americans to easily deduct $600 in donations to qualifying.

Charitable Tax Deduction, Secondly, in the case of married couples filing jointly, the deduction limit is $600 if both spouses contribute. The legislation would raise the $300/$600 cap to roughly $4,600 for individuals/$9,200 for couples and extend the deduction through years 2025 and 2025.

New IRS deduction could help you get a bigger tax refund in 2025, New irs tax '$600 rule' for side hustles: April 28, 2025 | last updated:

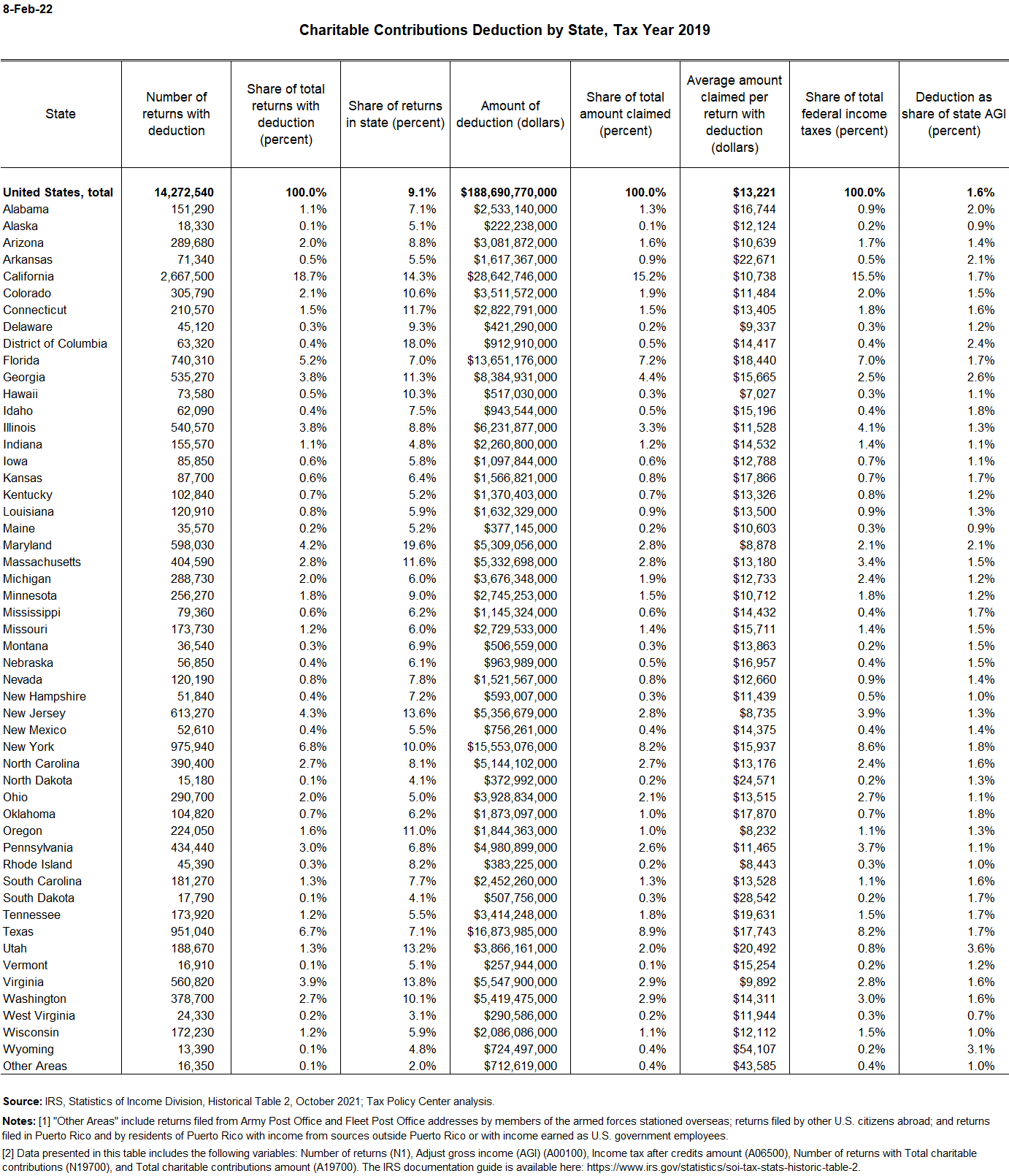

Charitable Deduction by State Tax Policy Center, April 28, 2025 | last updated: In a recent press release, the irs reminds taxpayers that a special tax provision will allow more americans to easily deduct $600 in donations to qualifying.

The increased deduction limit, which is $600 for married couples, is aimed at sustaining charitable giving during the coronavirus pandemic.